Kujira Community Funding proposal for CALC

Introduction

Do you believe in the long-term growth of crypto assets but find yourself asking “When do I buy?”

Have you ever tried to time the market but missed the mark?

You’re not alone.

The truth is that no one can predict the market. Anyone that tells you they can, is simply lying.

A Lower Risk strategy

Enter dollar-cost averaging. We are all familiar with DCA’ing.

- You don’t need an advanced degree in finance to understand how dollar-cost averaging works and why it’s beneficial.

- DCA favours consistency over technical analysis and still manages to beat timing the market 82% of the time.

- Investors can focus on living their life because trades happen automatically at preset intervals.

This is pretty standard to most centralised exchanges. They have been pushing reoccurring buys for some time and the concept is tried and tested. It benefits the long-term investor and is ideal for crypto’s volatile markets.

But… Current Centralised Offerings Aren’t Perfect.

Current off-chain, centralised solutions are lacking in a number of areas:

They require user trust of the centralised entity

- The recent events with Celsius is a good reminder of this: Not your keys, not your crypto.

They are not composable with DeFi Protocols

- This leads to reduced capital efficiency

Can We Do Better?

Absolutely.

Introducing CALC

A decentralised dollar-cost averaging protocol that provides advanced algorithms for long-term investing.

CALC offers 3 benefits to the end user:

- Advanced DCA Algorithms

- CALC provides both standard dollar-cost averaging and more technically advanced algorithms to ensure you get the best investment price.

- No Centralised Exchanges

- Swaps occur on decentralised exchanges and the coins are deposited directly into your on-chain wallet.

- Seamless user experience

- Simple to set up, use, modify and we even provide a dashboard so you can track your performance.

CALC Initial Products

We will own the niche of decentralised reoccurring token purchasing with the ambition to expand into profit taking when the bull market resumes.

- Dollar Cost Averaging

- Making reoccurring purchases of your favourite crypto assets simple while removing the need for centralised custody.

- Dollar Cost Averaging Plus

- Leverage our more advanced algorithm for reoccurring purchases with the aim of out performing average price.

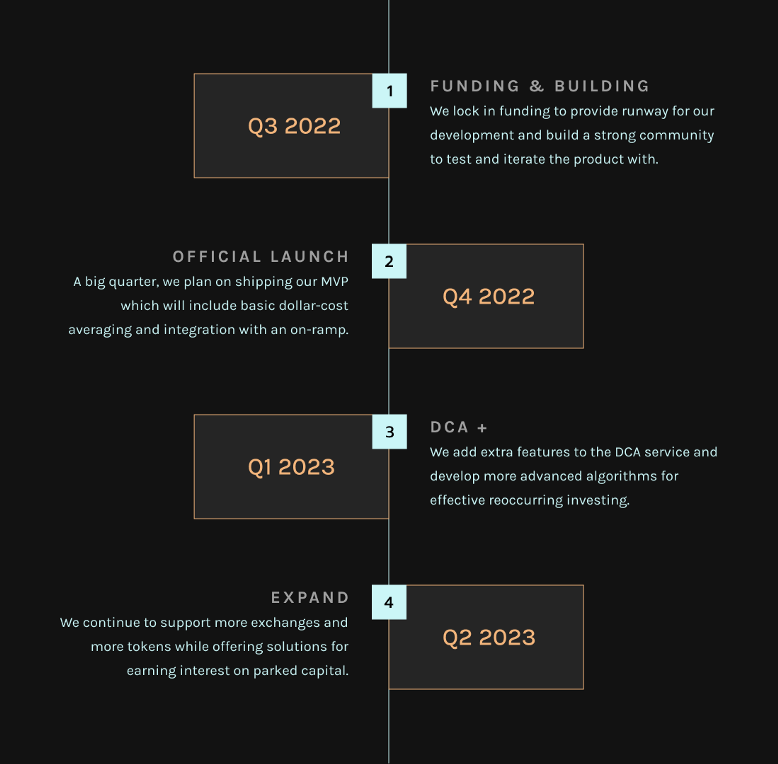

The Roadmap

We will leverage a lean start-up approach to development and focus on user needs.

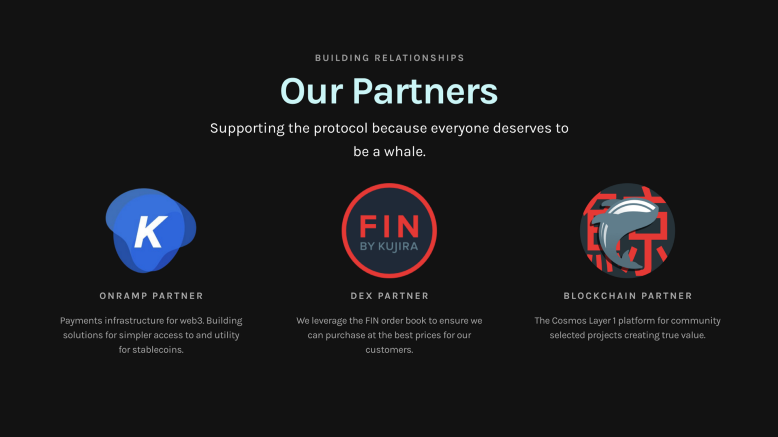

CALC Partners

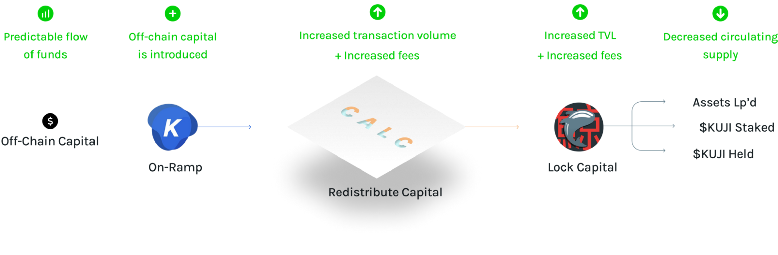

CALC attracts off-chain capital to the Kujira ecosystem.

How CALC Benefits $KUJI Stakers And The Kujira Ecosystem

Blockchains often exist in a liquidity vacuum with protocols or chains competing with each other for the same on-chain capital. The main value CALC delivers for Kujira is bridging capital from the fiat world onto the Kujira blockchain. Liquidity is king and a mandatory component for a successful order-book type DEX and a sovereign blockchain.

CALC:

- Increases transaction volume on Kujira

- Accrues more fees for $KUJI stakers

- Increases Kujira TVL

- Increases Kujira liquidity

- Decreases circulating supply of the $KUJI token (reduced supply leads to increased price)

- Builds brand presence for Kujira and develops user trust

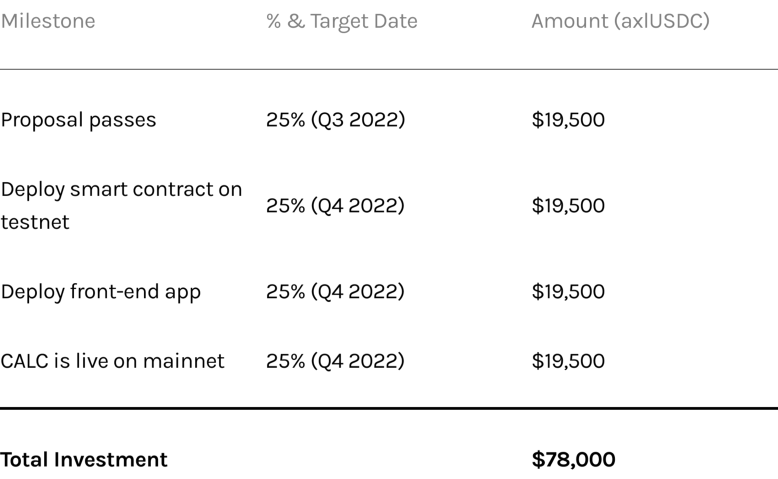

Our Ask

We’re Raising $78k.

This funds a 3-month runway for our engineering team, integration costs and audit costs to ship version 1 of the CALC protocol to Kujira main-net.

Our version 1 launch target of Q4 2022 will include an end-to-end functioning dollar-cost averaging service on the Kujira blockchain.

Expense Breakdown

Delivery Milestones

Our Mission

We want to transform the average retail investor into a calculated & educated, long-term investor.

Current-day Twitter shilling, ponzinomics, and predatory behavior, largely disadvantage the inexperienced retail investor. Our products combat emotional buying and educate the average retail investors so they don’t end up as exit liquidity.

The Founding Team

We’re an experienced team that ships quality. We love the “Just get on with it” mentality that the Kujira team continued to demonstrate and we look forward to continuing this tradition.

The non-founding team includes:

- 1 x UX designer

- 1 x full stack developer

- 1 x smart contract developer

- 1 x data scientist

- 1 x lawyer (part time)

Some of the brands we have worked with:

FAQ’s

Will CALC have a token?

We will not launch with a native token to ensure the product delivers value beyond the hype of token speculation. After delivering value and if demand is present, aligning with the ethos of grown up DeFi, we will introduce a utility token. Yes, we will include an airdrop to $KUJI stakers.

Which tokens will CALC support dollar-cost averaging in version 1?

At a minimum we will support $KUJI but plan on supporting anything that is trading on FIN.

I love the idea and I want to get involved, what do i do?

That is great to hear, we can always use helping hands as we know there is a diverse skillset on the Kujira community. Reach out to us via Twitter at @CALC_Finance

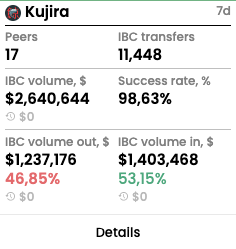

Can you quantify the impact that CALC could have on stable coin volume inflow on to Kujira?

This is the current flow of capital on Kujira sampled on a random 7-day period, where $1,205,562 is from Axelar:

The current flow of iBC stable coin capital from Axelar alone in the last 30 days can be found below:

If CALC could match just 5% of that demand then the market cap of Kujira would increase ~4 Million every 30 days.

The CALC disclaimer can be found here.

Subscribe to our newsletter

Lorem ipsum dolor sit amet nsectetur adipiscing elit lobortis arcu enim.